The development and distribution of medicinal products are associated with high risks and are subject to strict legal requirements. Pharmaceutical companies not only have a special responsibility towards patients, but must also protect themselves against complex liability risks. This is precisely where pharmaceutical product liability insurance comes in - an indispensable part of your risk management. It not only protects your patients, but also your company from financial losses and ensures compliance with legal requirements.

The manufacture, testing and distribution of medicinal products in Germany are subject to the strict requirements of the German Medicinal Products Act (AMG). These must be fulfilled by all companies that place medicinal products on the market in Germany. It does not matter whether they are based inside or outside the European Union.

Pharmaceuticals are essential for healthcare, but they also harbor risks. Unforeseeable side effects or errors in production can cause considerable damage - both to patients and to your company. Under Section 94 of the German Medicinal Products Act (AMG), pharmaceutical companies are obliged to take precautions against claims for damages .

Of particular note is strict liability, which applies regardless of fault. This means that even if a medicinal product is used correctly, you as a pharmaceutical company are liable for any damage. Such a liability risk is considerable - both for the health of those affected and for the financial stability of your company. This is why the legislator(§ 94 AMG) requires binding proof of sufficient cover, e.g. through product liability insurance.

Your liability: Strict liability and no-fault risks

Pharmaceutical companies are liable not only for their own fault, but also regardless of fault - for example in the event of unforeseeable damage caused by correctly used medicinal products. The minimum cover amounts are stipulated by law(Section 88 AMG) and total 120 million euros in the event of damage caused by the same medicinal product to several people.

"We understand that behind every product there is always a responsibility towards people. That's why it's important to us not only to comply with legal requirements, but also to protect companies from financial and reputational damage."

Jutta Zaglauer - Senior Risk Advisor Life Sciences Atrialis GmbH

1 What is product liability insurance and when does it apply?

Product liability insurance refers to the responsibility of a manufacturer or distributor for damage caused by defective products. In the context of the pharmaceutical industry, liability arises from the German Medicinal Products Act (AMG).

Important to know: The strict liability(§ 84 AMG) applies regardless of whether the pharmaceutical company can be proven to be at fault.

➔ The insurance takes effect in cases where claims for damages are asserted - whether due to production errors, unforeseeable side effects or faulty deliveries. Product liability insurance also offers protection in the event of recalls that are necessary due to legal requirements or official instructions.

2 What does pharmaceutical product liability insurance cover?

Pharmaceutical product liability insurance offers pharmaceutical companies comprehensive protection against:

1. basic coverProtection against claims for damages arising from the use of your products. This includes:

2. late damageDamage that only occurs years after use is also covered. The so-called late damage risk is a central aspect of insurance design. Insurance policies cover such cases by covers:

In addition, worldwide damage caused by medicinal products distributed within the scope of the AMG is also covered. For exports outside this scope, especially to particularly demanding markets such as the USA or Canada, special solutions offer protection against exceptional cases of liability.

3. what does pharmaceutical product liability insurance cost?

The cost of product liability insurance under the AMG can vary greatly and depends on several factors, including

➔ The costs vary depending on the size and risk profile of the company. For smaller companies, the costs are around 500 to 2,500 EUR per year. Larger groups, on the other hand, should expect insurance costs of at least 2,500 EUR per year, although the costs are open-ended.

We analyze your individual risk profile and your specific requirements in order to provide you with a precise quote. Please do not hesitate to contact us.

4 What are risks that you as a pharmaceutical company should not underestimate?

Our solution: Clear contracts with your suppliers and the conclusion of waiver of recourse insurance or other special cover.

Our solution: extended liability insurance that has been specifically developed for such scenarios.

Pharmaceutical companies must not only fulfill the requirements of the AMG, but also observe international liability risks and compliance requirements in order to avoid costly damages.

German legislation requires insurers to offer pharmaceutical companies insurance cover on reasonable terms. Through a so-called pool construction ("pharmaceutical pool") ensures that smaller companies also have access to comprehensive cover. comprehensive cover have access to comprehensive cover.

In order to minimize the financial burden even in the event of extreme losses, insurers resort to reinsurance . This is an additional form of cover in which part of the risk is transferred to specialized reinsurance companies. The so-called "pharmaceutical pool" also exists to cover particularly high risks in the pharmaceutical industry . This pooling of several insurers ensures a solidarity-based risk equalization and enables even smaller companies to be comprehensively insured at affordable conditions.

The "Pharma Pool" is an association of around 50 members, coordinated by Munich Re. It works on the basis of a pro rata distribution according to pool shares, whereby each member is liable according to its share. Important: the members are not jointly and severally liable. The Pharmapool thus enables a collective and fair distribution of risk. This tranche concept offers a safe and transparent solution to meet the legal requirements of the AMG.

➔ Reinsurance and the "pharma pool" thus form a double safety net to provide optimum protection for all parties involved.

The requirements for pharmaceutical product liability insurance are complex.

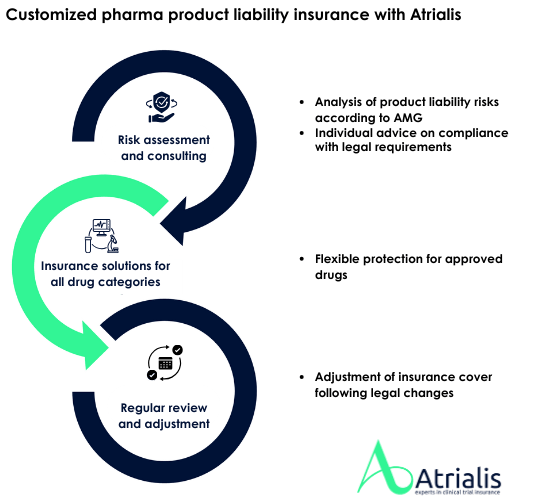

As an insurance broker, we help you to minimize risks and find the right insurance cover. At Atrialis, we offer you tailor-made solutions:

Pharmaceutical product liability insurance is far more than just a legal obligation - it is your protective shield against existential risks!

We provide you with expert advice and develop an insurance solution that fits your company perfectly. You can rely on our years of experience and know-how to find the perfect solution for your specific requirements.

Protect your company, your patients and your reputation. Contact us - together we will develop a customized concept for your security!